Q2/22 MAFSI Business Barometer Reports Sales Continue Strong but Moderating; Industry Normalizing as COVID Impact Abates

September 19, 2022

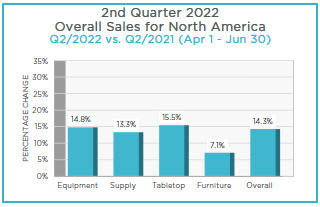

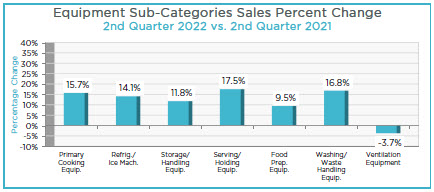

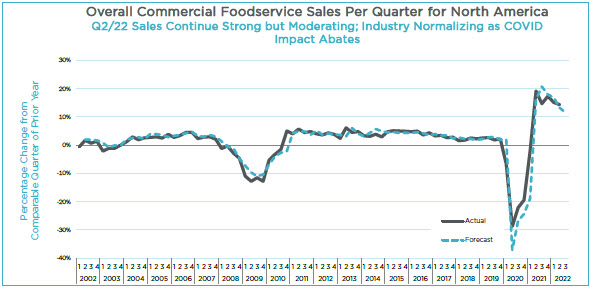

Overall sales for Q2/22 continued strong with an increase of +14.3%. This represents the third consecutive quarter of ebbing growth, while still double-digit, having receded from +17.3% in Q4/21, +15.2% in Q1/22, +14.3% in Q2/22, and down from a record high of +19.1% in Q2/21.

The forecast for the past 5 quarters has declined from +20.7%, +17.9%, +16.8%, +13.2% and now to +11.5%. Clearly, the exuberance of the Foodservice Equipment & Supply climate is continuing to "normalize". For reference, the industry has historically operated within a range of 1% to 5% growth over the long run.

The forecast for the past 5 quarters has declined from +20.7%, +17.9%, +16.8%, +13.2% and now to +11.5%. Clearly, the exuberance of the Foodservice Equipment & Supply climate is continuing to "normalize". For reference, the industry has historically operated within a range of 1% to 5% growth over the long run.

Clearly what is occurring is that the "COVID Bubble" is gradually passing through the system, both in terms of the initial shutdown of our marketplace and the subsequent surge of unprecedented demand and resultant depressed comparable when the market reopened.

Advanced ordering of projects and attempts to place large stock orders for products in short supply as well as to beat large and frequent price increases have subsided as lead times have improved and demand for products slowed down.

Rising interest rates intended by the Fed to cool inflection, lowered gasoline prices, full employment, continued labor shortages, improving supply chain matters, and lowering concerns of a recession are all issues to watch as we gradually return to stability.

See Full Report - Qtr 2 2022 MAFSI Business Barometer

Executive Summary written by Michael R. Posternak, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com

Comments