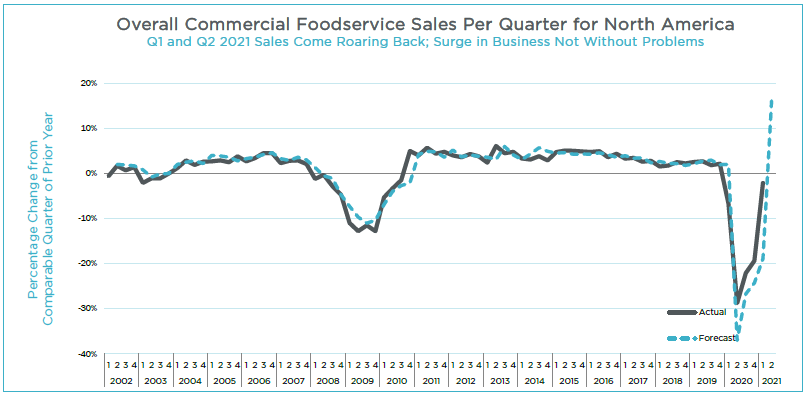

Q1 and Q2 2021 Foodservice Sales Come Roaring Back; Surge in Business Not Without Problems

June 3, 2021

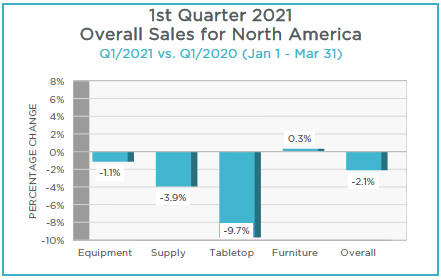

Overall sales in the 1st Quarter of 2021 were reduced by a further -2.1%, in comparison to the mostly “pre-COVID” period of Q1/20. This was an improvement from the -19.4% plunge for Q4/20 and the forecasted -18.9% for Q1/21. It was also on par with the Q1/21 reports of the industry’s 6 public companies of +0.5%, as tracked by Clarity M&A, LLC.

By category, the breakdown is Furniture is +0.3%, Equipment -1.1%, Supply -3.9%, and Tabletop -9.7%.

Regional variations were widespread and somewhat predictable, given geographic and political COVID factors such as a second or third wave and the degree of easing of restrictions. Further declines were felt in the West at -9.8% and the Midwest at -7.7% while the Northeast stabilized at +0.3%. Canada grew by +2.7%, and the South led by Texas and Florida gained +5.8%.

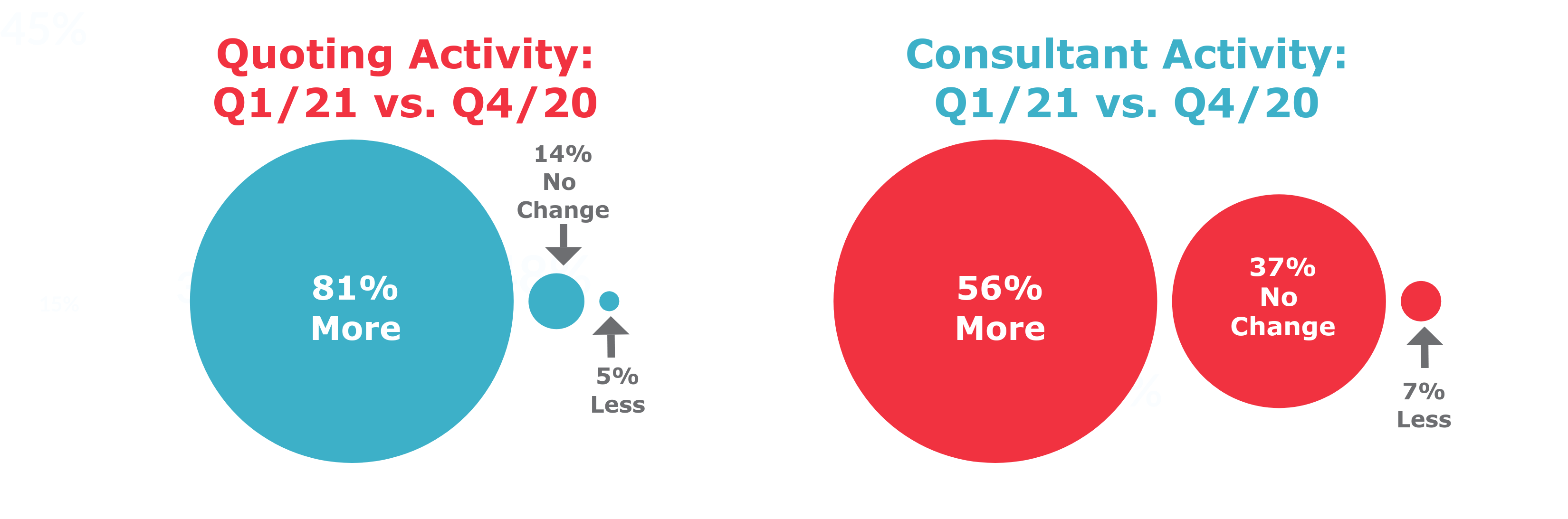

The forecast for Q2/21 is wide open with huge gains predicted for all markets ranging from +14.6% in the South, +15.3% in both the Northeast and Midwest, to +15.6% in the West, and +21.4% in Canada. With the return to normalcy, the recovery is dramatic in its intensity with 81% of reps reporting they are quoting more and 56% are seeing more specs. Although highly welcomed, this surge of business is not without challenges for the Foodservice Industry.

Demand is quickly outstripping supply as manufacturers deal with a variety of problems as they expand their capacity from decimated COVID levels. These issues include labor, supply, and wage pressures, raw material shortages, and transportation availability. These inflationary pressures are leading to second rounds of price increases, advancing of order placement, longer lead times and in some cases, hoarding and resultant shortages. The market is very rapidly shifting from “Just in Time” to “Not in Time”.

Eventually, this surge of business will level off as supply and demand rebalance. The population is shifting from California and New York to Texas and Florida which are long-term trends. Add to this, the activity reported by Clarity M&A, LLC, at the dealer, rep, and for sure, the manufacturer levels, we are certainly in for some dynamic and unprecedented times ahead.

See Full Report - Qtr 1, 2021 MAFSI Business Barometer.

Executive Summary written by Michael R. Posternak, PBAC and Associates, Eastchester, NY. Mp@pbacrep.com.

Comments