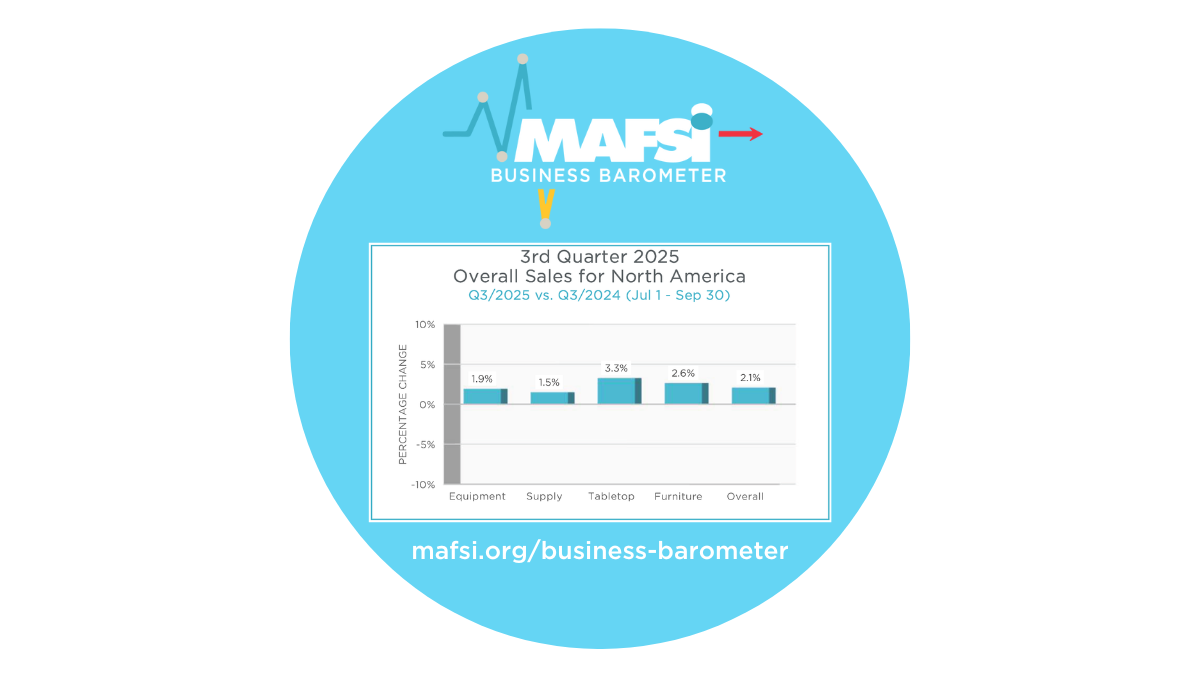

Q3/2025 MAFSI Business Barometer: MAFSI Q3/25 Barometer records 2nd Consecutive Quarter of Modest Growth and 2026 Forecast at 4.3%

November 13, 2025

MAFSI Q3/25 Barometer records 2nd Consecutive Quarter of Modest Growth;

2026 Market Forecast at 4.3%

Q3/25 sales improved to +2.1% vs. +1.6% in Q2/25 and just short of the forecast of +2.7%. SpecPath projects for Q3 decline by -13.3%

See Full 2026 Market Forecast on Page 6

See the Q3 2025 Commercial Foodservice Business Barometer & 2026 Market Forecast

Q3/25 sales improved to +2.1% vs. +1.6% in Q2/25 and just short of the forecast of +2.7%. This was the second consecutive modest gain in quarterly sales.

Over the past 7 quarters, sales were 0.0%, -1.0%, -0.6%, +0.2%, 0.0%, +1.6%, and now +2.1%.

The market has moved to slightly positive ground after 15 months of negative growth.

By product category, sales were +3.3% Tabletop, +2.6% Furniture, +1.9% Equipment, and +1.5% Supply.

By region, Q3/25 Sales were Midwest +3.0%, South and Northeast+2.9%, Canada 0.7%, and West -1.4%.

Both Quoting and Consultant Activity declined as reps reported less volume. This dual decline is collaborated by data from MAFSI'S Spec Path which recorded 824 projects for Q3/25 vs. 950 in Q3/24, for a decline of -13.3%.

The forecast for Q4/25 is +1.7% and a preliminary forecast for calendar 2026 is optimistically set for +4.3%.

After a prolonged period of Stagflation, the market seems to be showing signs of modest growth. Fears of disruptive tariffs appear to be abating, the Energy Star Program looks like it might survive, and manufacturer's growth expectations are more modest.

Executive Summary written by Michael R. Posternak, CEO, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com.

See the Q3 2025 Commercial Foodservice Business Barometer & 2026 Market Forecast.

Comments