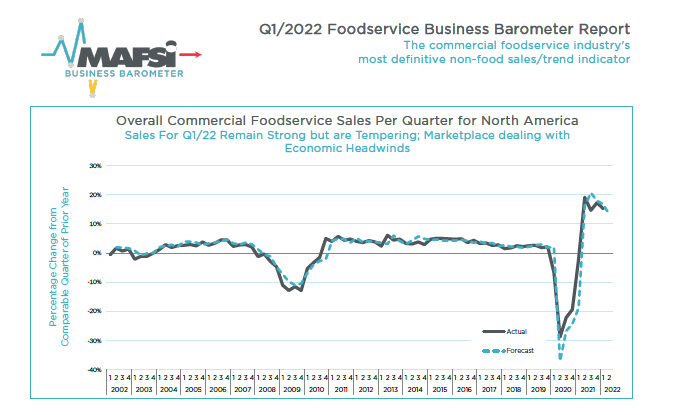

MAFSI Business Barometer Reports Sales for Q1/22 Remain Strong but are Tempering; Marketplace Dealing with Economic Headwinds

June 17, 2022

Overall sales in Q3/21 climbed by +15.4% compared to Q3/20. This was less than the +20.7% increase that had been forecasted for Q3/21 and less than the +19.1% advance of Q2/21. It should be recognized, however, that Q2/20 was the nadir of the 2020 pandemic whereas Q3/20 was less severe, hence they are uneven prior year comparables.

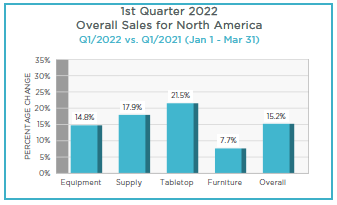

Overall sales for Q1/22 continued strong at +15.2%, a bit short of the forecast of +16.8%, less than the gain of +17.3% of Q4/21, and down from the MBB record gain of +19.1% of Q2/21. These results, as well as the forecast of +13.2% for Q2/22 represent the gradual tempering of the Food Service business climate as our industry moves towards normalization.

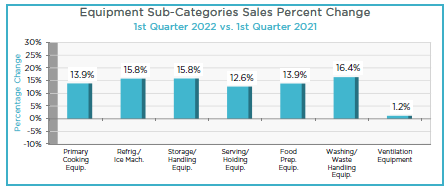

The breakdown for Q1/22 overall sales by category was +21.5% for Tabletop, +17.9% for Supplies, +14.8% for Equipment, and +7.7% for Furniture. By Region, the Northeast recorded a gain of +18.9%, followed by Canada at +17.1%, the South at +15.8%, the Midwest at +15.7%, and the West at +8.2%.

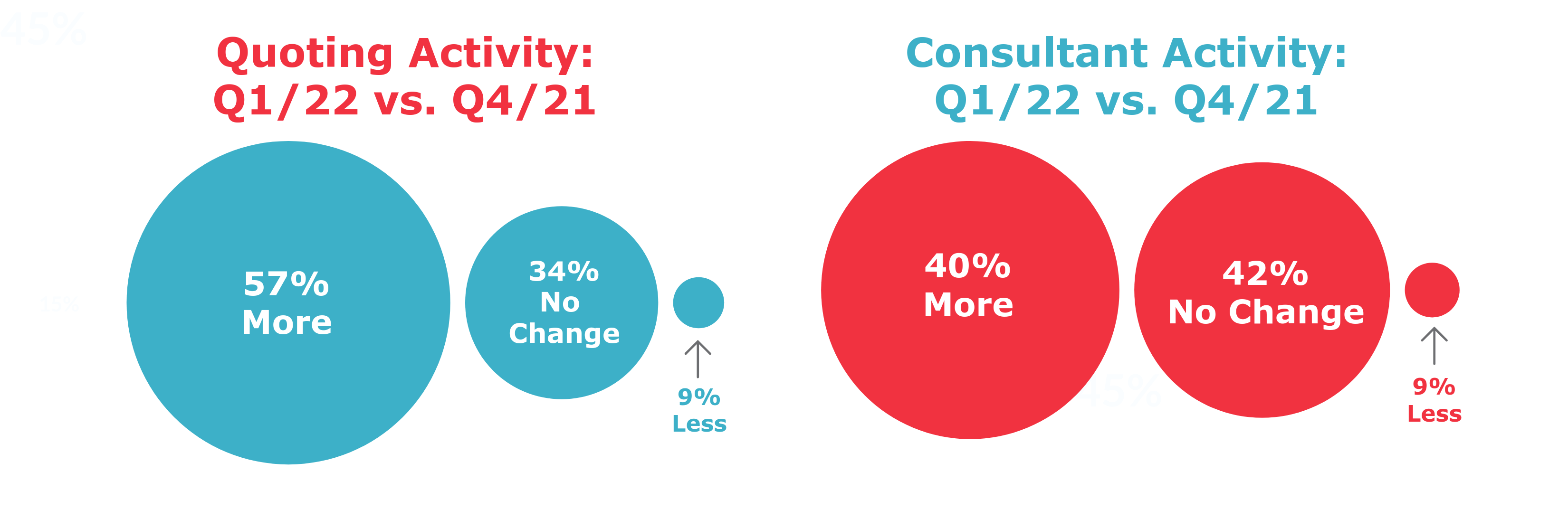

Consultant Activity also slipped a notch to 40% reporting More vs. 49% More last quarter. Quotation Activity held at 57% reporting More.

The price escalation of most Food Service Equipment products has outpaced the overall Producer Price Index (PPI) by a margin of 2 to 3 times faster. As increasing supply is gradually catching up somewhat to slowing demand, lead times have begun to show some improvement.

See Full Report - Qtr 1 2022 MAFSI Business Barometer

Executive Summary written by Michael R. Posternak, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com

Comments