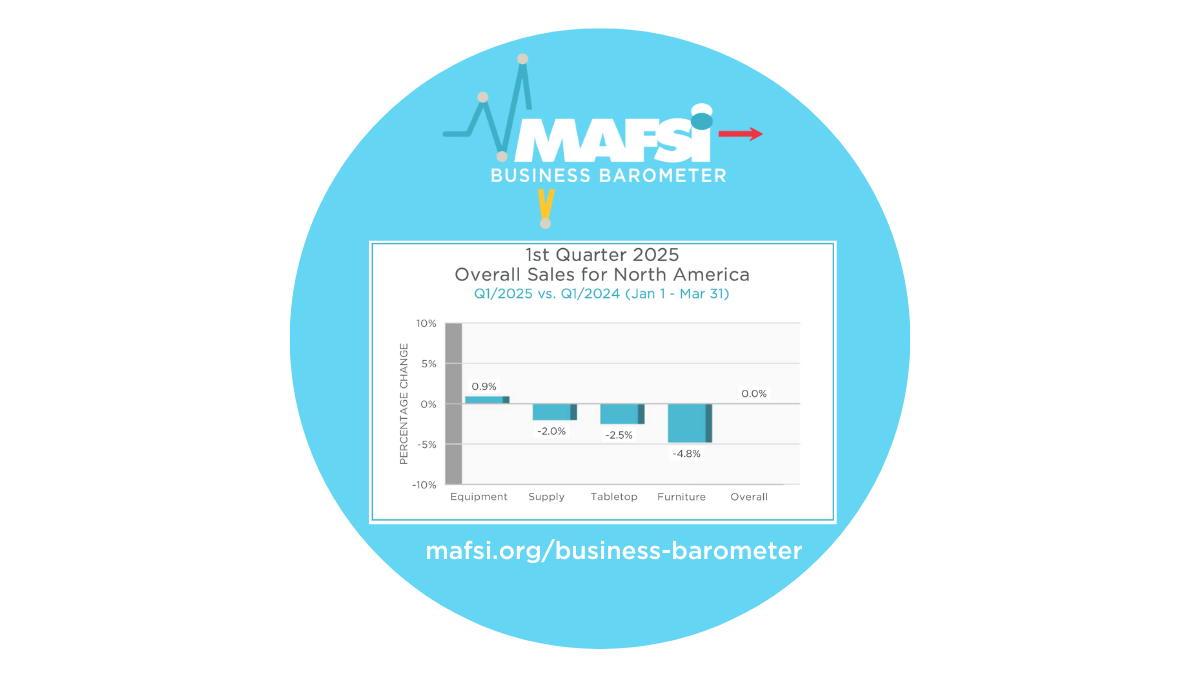

Q1/2025 MAFSI Business Barometer: Industry Is Flat At Best Coupled With Stagflation and Uncertainty

May 14, 2025

Industry Is Flat At Best Coupled With

Stagflation and Uncertainty

Overall sales for first quarter 2025 were dead flat at 0%

for the second time in 5 quarters.

Over this period, quarterly sales changes were 0.0%,-1.0%,-0.6%, +0.2% and 0.0%, which averages out to 15 months of negativity.

See the Q1 2025 Commercial Foodservice Business Barometer.

Overall sales for first quarter 2025 were dead flat at 0% for the second time in 5 quarters.

Over this period, quarterly sales changes were 0.0%,-1.0%,-0.6%, +0.2% and 0.0%, which averages out to 15 months of negativity.

By product category, Equipment was up +0.9%, while Supply, Tabletop, and Furniture were down by -2.0%, -2.5% and -4.8%.

By region, Northeast contracted by -2.3%, Midwest -0.7%, while the South increased 0.3%, West 2.0% and Canada 3.3%. Consultant and Quoting activity reflected similar contractions.

The forecast for the second quarter of 2025 is a mere increase of +1.0%.

In fact, we are now in the fourth year of slowing negative sales with further concerns on the horizon, due to tariff-induced supply distortions.

Similarly to the early days of Covid, we are in the midst of uncertainty. “Yo-Yo” tariffs make it nearly impossible to forecast future outcomes and to plan prudent actions.

Some manufacturers have been advancing orders in the hope of beating tariffs, while others have been freezing or cancelling orders. Pricing is holding or increasing while growth is absent, creating a climate of “Stagflation” and "Uncertainty."

Executive Summary written by Michael R. Posternak, CEO, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com.

See the Q1 2025 Commercial Foodservice Business Barometer.

Comments