Q1/2023 MAFSI Business Barometer: Industry Sales Growth Continues to Flatten As Business Normalizes, Second Half Looks More Challenging

July 10, 2023

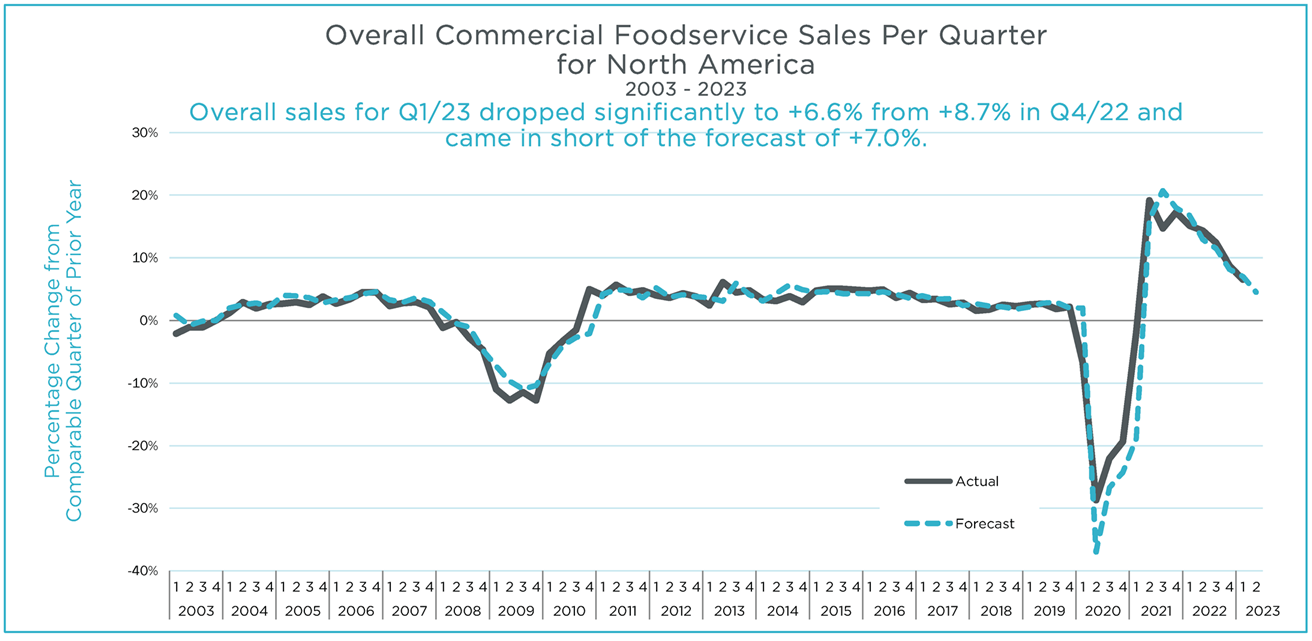

Overall sales for Q1/23 dropped significantly to +6.6% from +8.7% in Q4/22 and came in short of the forecast of +7.0%.

See the Q1 2023 Commercial Foodservice Business Barometer.

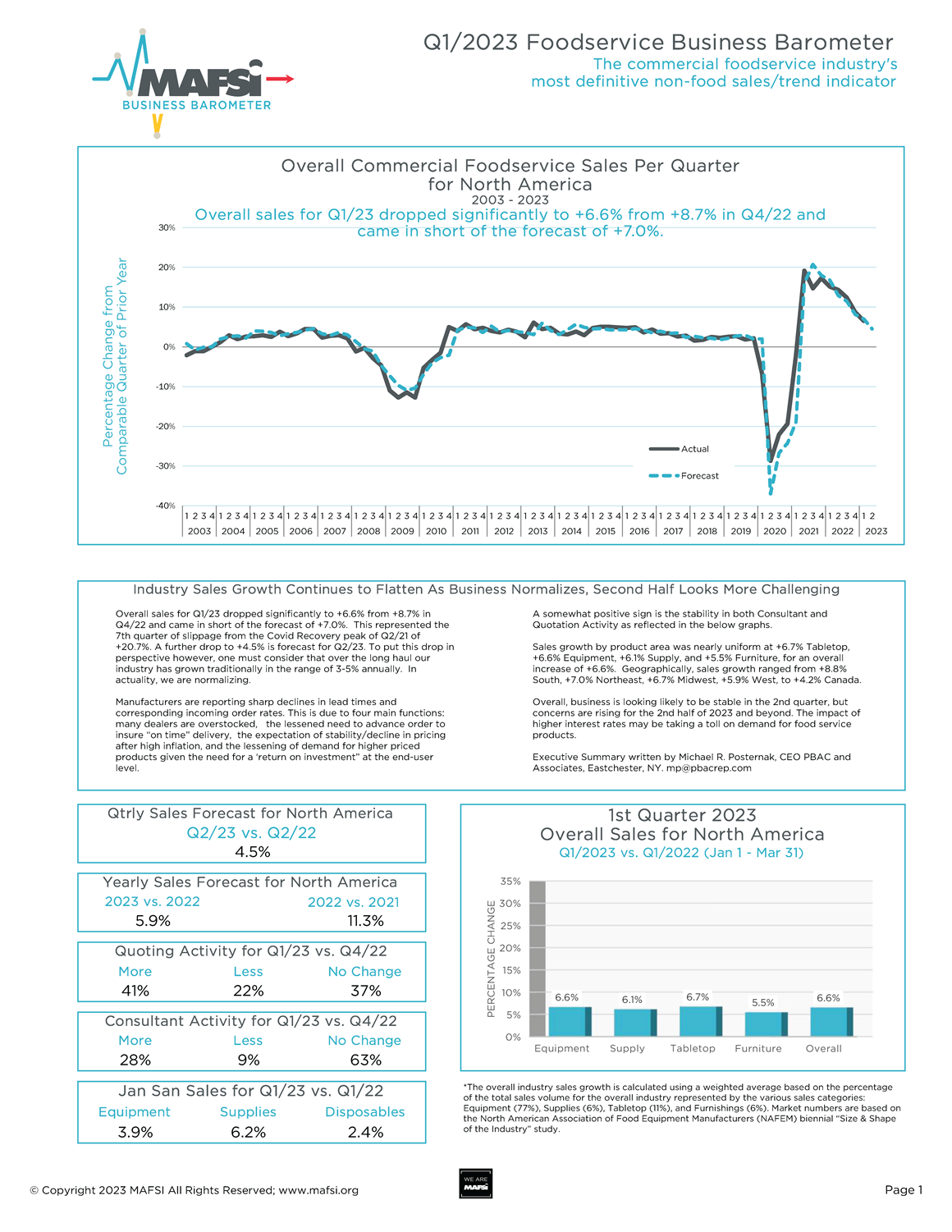

Overall sales for Q1/23 dropped significantly to +6.6% from +8.7% in Q4/22 and came in short of the forecast of +7.0%.

This represented the 7th quarter of slippage from the COVID Recovery peak of Q2/21 of +20.7%. A further drop to +4.5% is forecast for Q2/23. To put this drop in perspective however, one must consider that over the long haul our industry has grown traditionally in the range of 3-5% annually. In actuality, we are normalizing.

Manufacturers are reporting sharp declines in lead times and corresponding incoming order rates. This is due to four main functions: many dealers are overstocked, the lessened need to advance order to insure “on time” delivery, the expectation of stability/decline in pricing after high inflation, and the lessening of demand for higher priced products given the need for a ‘return on investment” at the end-user level.

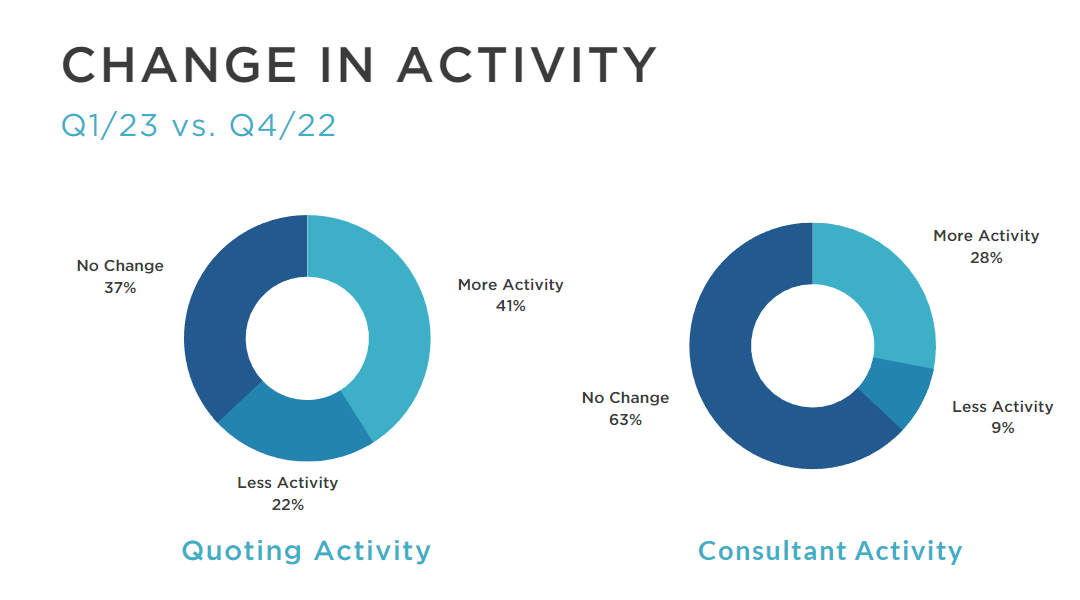

A somewhat positive sign is the stability in both Consultant and Quotation Activity as reflected in the below graphs.

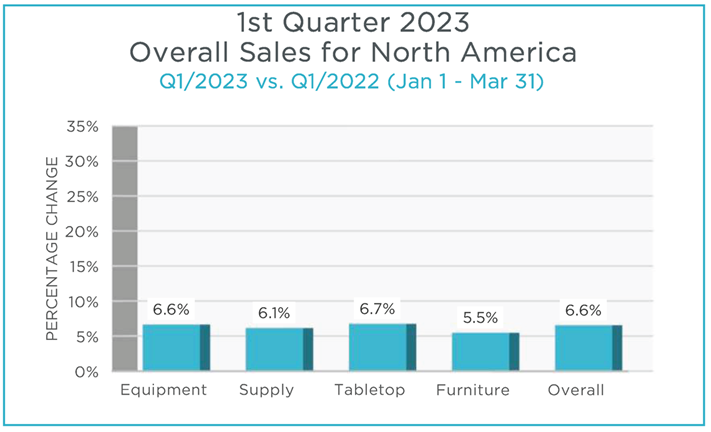

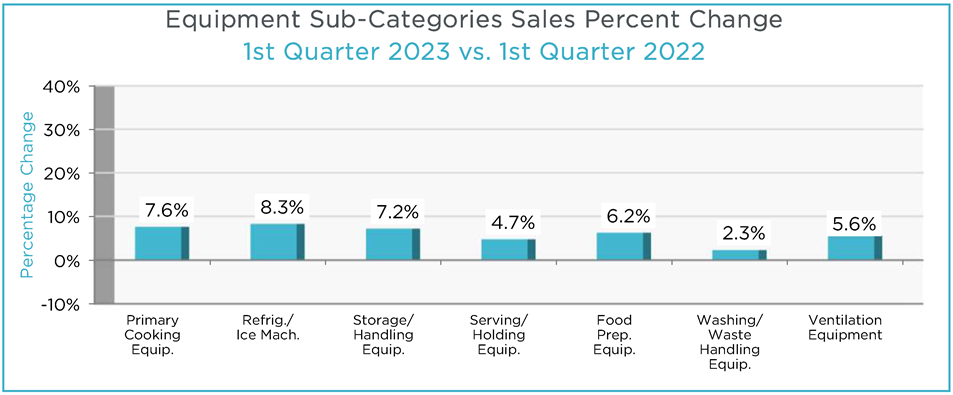

Sales growth by product area was nearly uniform at +6.7% Tabletop, +6.6% Equipment, +6.1% Supply, and +5.5% Furniture, for an overall increase of +6.6%. Geographically, sales growth ranged from +8.8% South, +7.0% Northeast, +6.7% Midwest, +5.9% West, to +4.2% Canada.

Overall, business is looking likely to be stable in the 2nd quarter, but concerns are rising for the 2nd half of 2023 and beyond. The impact of higher interest rates may be taking a toll on demand for food service products.

Executive Summary written by Michael R. Posternak, CEO, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com.

See the Q1 2023 Commercial Foodservice Business Barometer.

Comments