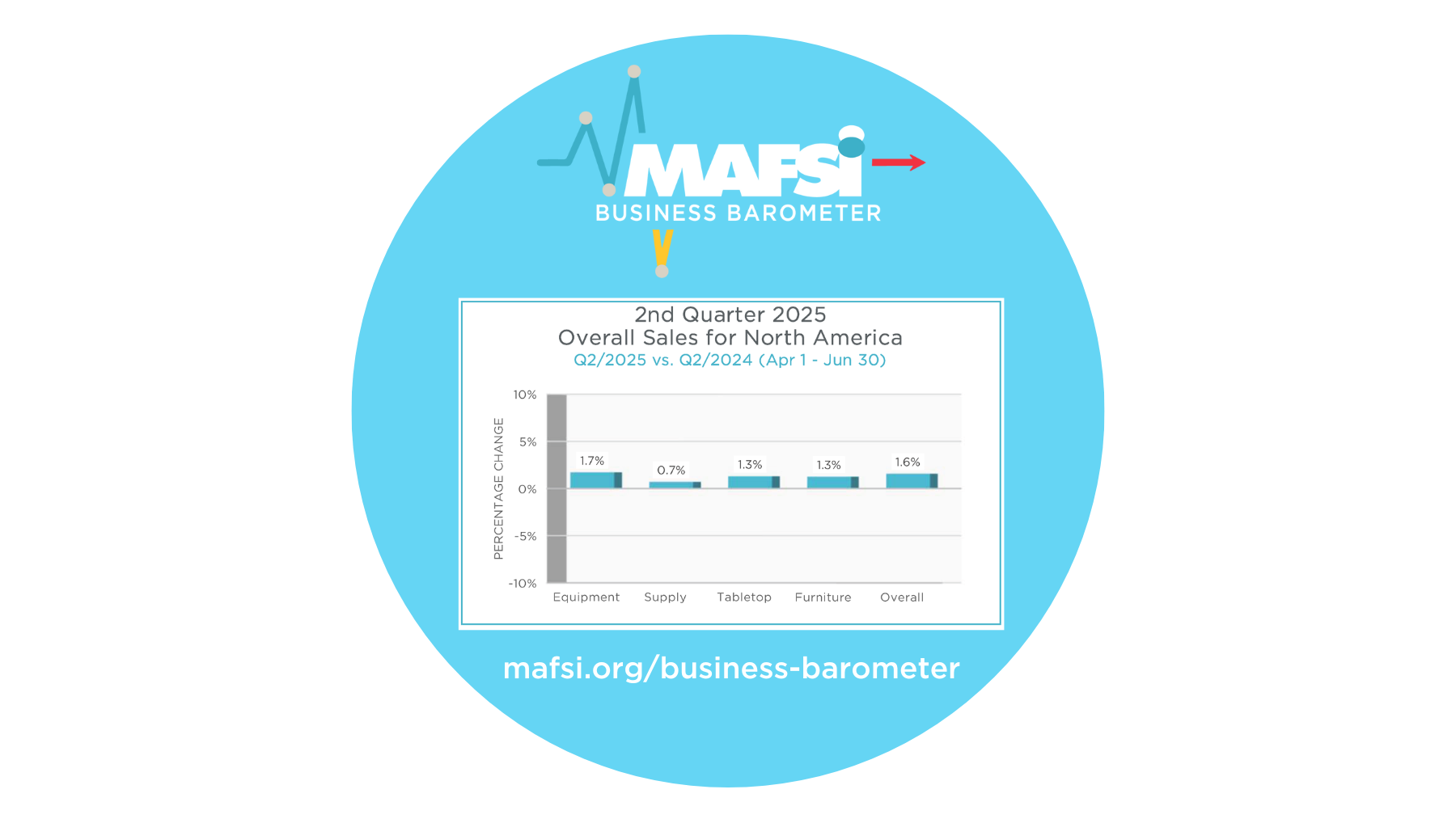

Q2/2025 MAFSI Business Barometer: Modest Growth of + 1.6% achieved in Q2/25; Tariff Impact Still a Threat

September 8, 2025

Modest Growth of + 1.6% achieved in Q2/25;

Tariff Impact Still a Threat

Q2/25 sales showed a slight gain of +1.6% versus 0% last quarter

and the largest, albeit modest, gain in 18 months.

Over this period, quarterly sales changes were 0.0%,-1.0%,-0.6%, +0.2%, and 0.0%. On Wall Street this movement is referred to as “dead cat bounce.”

NEW! SpecPath Project Data - See Page 5

See the Q2 2025 Commercial Foodservice Business Barometer.

Q2/25 sales showed a slight gain of +1.6% versus 0% last quarter and the largest, albeit modest, gain in 18 months. Over this period, quarterly sales changes were 0.0%,-1.0%,-0.6%, +0.2%, and 0.0%. On Wall Street this movement is referred to as “dead cat bounce.”

By product, Equipment was up +1.7%, Tabletop and Furniture up +1.6% and Supply -0.7%.

By region, Northeast gained +2.9%, The West +2.7%, Midwest +2.0%, The South +1.1%, while Canada declined by -0.6%.

Quoting activity increased while, paradoxically, Consultant activity shrank.

The forecast for the third quarter 2025 is for an increase of +2.7%, in line with our 2025 Annual Forecast number.

Sluggish growth, at this point, seems to be the best case scenario. The temperature of the market can also now be measured by the change in activity in MAFSI’S SpecPath Report which tracked 1,859 projects in Q1 and Q2 2024 versus 1,895 projects in Q1 and Q2 2025 for an increase of 1.9%. See page 5 for our new SpecPath report. The disruptive effect of tariffs on the foodservice industry has not yet been fully realized and makes forecasting a nearly impossible task.

Executive Summary written by Michael R. Posternak, CEO, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com.

See the Q2 2025 Commercial Foodservice Business Barometer.

Comments