Q3/2023 MAFSI Business Barometer: Overall Sales Growth Slows For The 9th Consecutive Quarter, Industry Likely Heading For A Soft Landing

November 20, 2023

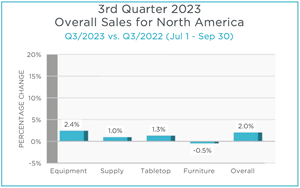

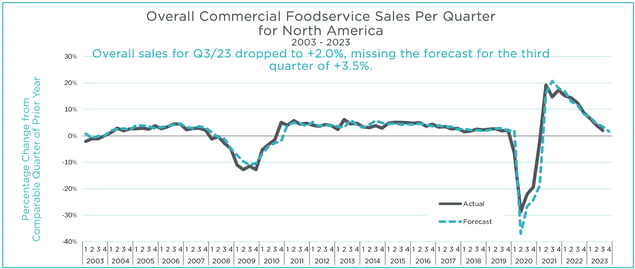

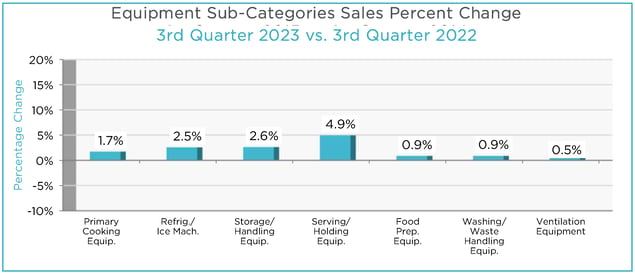

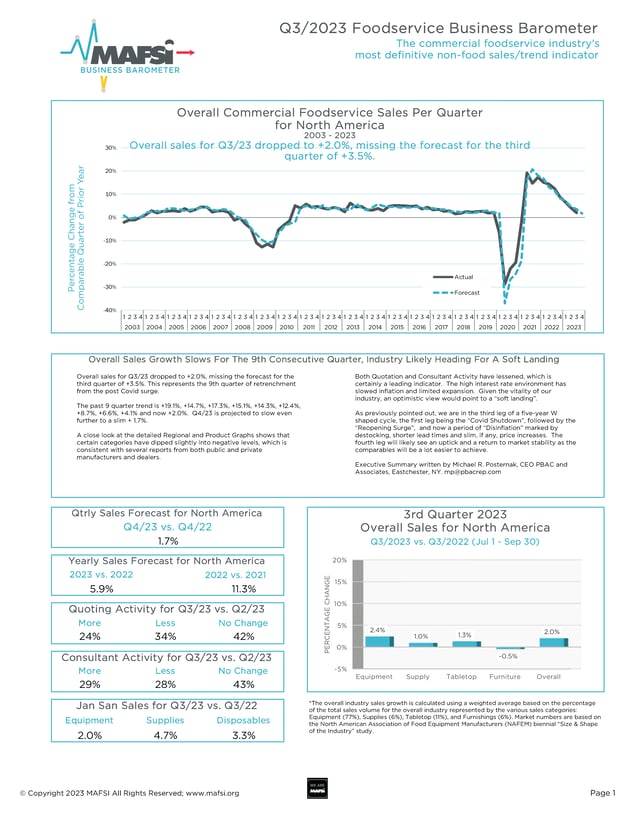

Overall sales for Q3/23 dropped to +2.0%, missing the forecast for the third quarter of +3.5%.

See the Q3 2023 Commercial Foodservice Business Barometer.

Overall sales for Q3/23 dropped to +2.0%, missing the forecast for the third quarter of +3.5%.

This represents the 9th quarter of retrenchment from the post Covid surge. The past 9 quarter trend is +19.1%, +14.7%, +17.3%, +15.1%, +14.3%, +12.4%, +8.7%, +6.6%, +4.1% and now +2.0%. Q4/23 is projected to slow even further to a slim + 1.7%.

A close look at the detailed Regional and Product Graphs shows that certain categories have dipped slightly into negative levels, which is consistent with several reports from both public and private manufacturers and dealers.

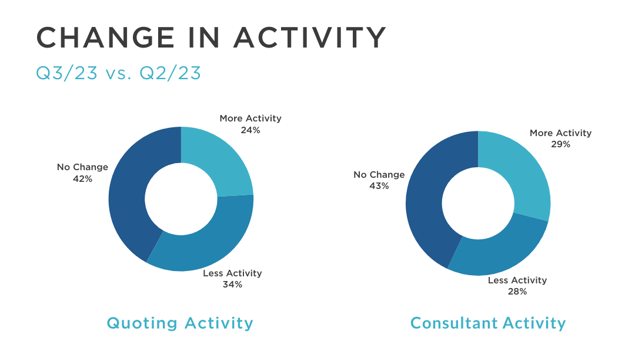

Both Quotation and Consultant Activity have lessened, which is certainly a leading indicator. The high interest rate environment has slowed inflation and limited expansion. Given the vitality of our industry, an optimistic view would point to a “soft landing”.

As previously pointed out, we are in the third leg of a five-year W shaped cycle, the first leg being the “Covid Shutdown”, followed by the “Reopening Surge”, and now a period of “Disinflation” marked by destocking, shorter lead times and slim, if any, price increases. The fourth leg will likely see an uptick and a return to market stability as the comparables will be a lot easier to achieve.

Executive Summary written by Michael R. Posternak, CEO, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com.

See the Q3 2023 Commercial Foodservice Business Barometer.

Comments