Strong Sales in Q2/21 as Manufacturers Struggle to Keep up with Unprecedented Demand

September 22, 2021

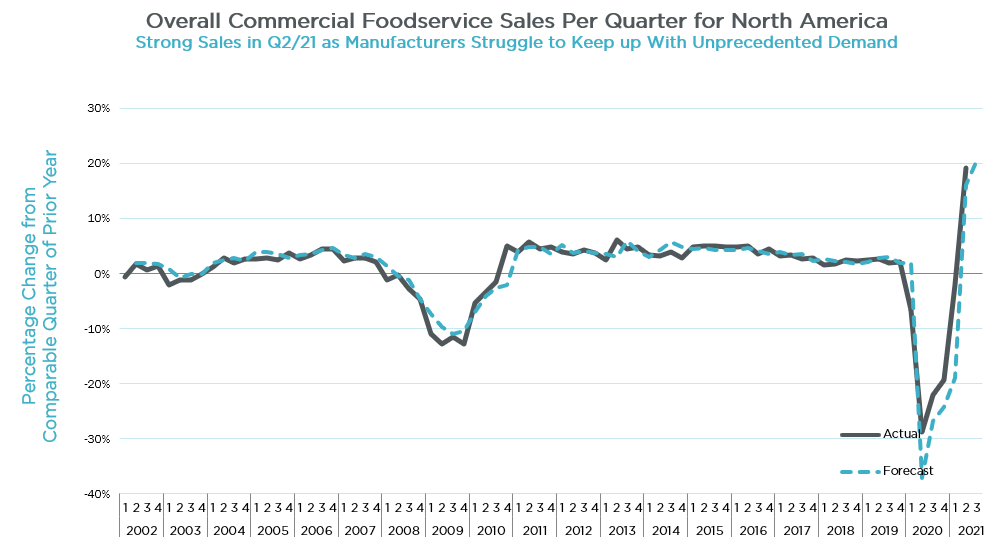

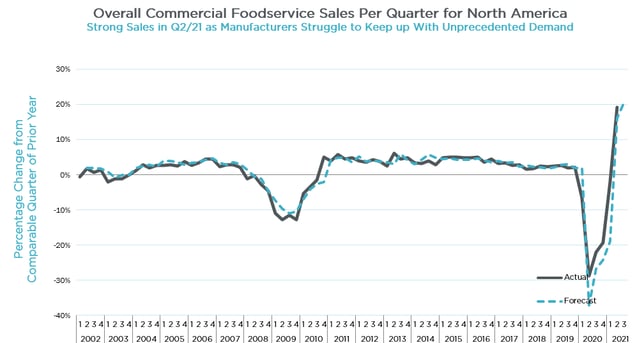

Overall sales in the second quarter of 2021 climbed by +19.1% compared to Q2/20. This was even greater than the +16.1% advance that had been forecasted for the quarter.

Although not tracked by the MAFSI Business Barometer, reported bookings were far in excess of actual shipments as evidenced by extremely long lead times, late deliveries, raw material shortages, labor issues, and transportation setbacks, all of which have manufacturers struggling to cope with this unprecedented surge in demand.

The breakdown for Q2 overall sales by category is +32.5% in Tabletop, +18.1% in Supplies, +17.7% in Equipment, and +15.9% in Furniture.

All regions reported strong advances when compared to the COVID shutdown period of Q2/20. Canada led the way with +31.6%, followed by the West at +23.7%, then the Northeast at +21.2%, and both the Midwest and South at +15.4%.

The overall forecast for Q3/21 compared to Q3/20 is +20.7% continuing the strong advance including regional forecasts from +26.0% in the Northeast, to +20.3% in Canada, to +20.0% in the Midwest, to +19.6% in the South, and +16.8% in the West.

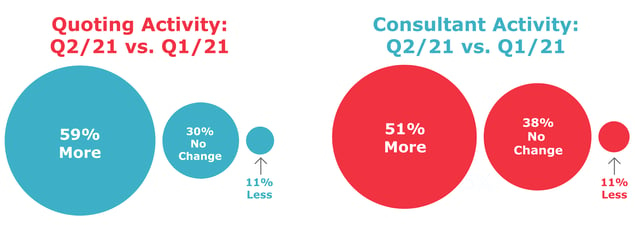

The expectation is that future activity will start to taper as evidenced by 51% of reps said they are quoting more this quarter vs. 81% from last quarter. Also 51% of reps reported more consultant specs this quarter vs. 56% of reps reported more specs last quarter.

However, it will take some time for the demand for foodservice products to stabilize as long lead times and escalating prices over-stimulate advance purchasing. Eventually, supply will catch up with demand.

The spread of the Delta variant has greatly delayed a return to normalcy, particularly in the areas of corporate dining, tourism, business travel, hotel bookings, and conventions.

A slowdown in restaurant reservations, as well as a decrease of new hirings in the hospitality market, are further signs of an upcoming deceleration of the exuberance that has captivated our industry.

See Full Report - Qtr 2, 2021 MAFSI Business Barometer

Executive Summary written by Michael R. Posternak, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com

Comments