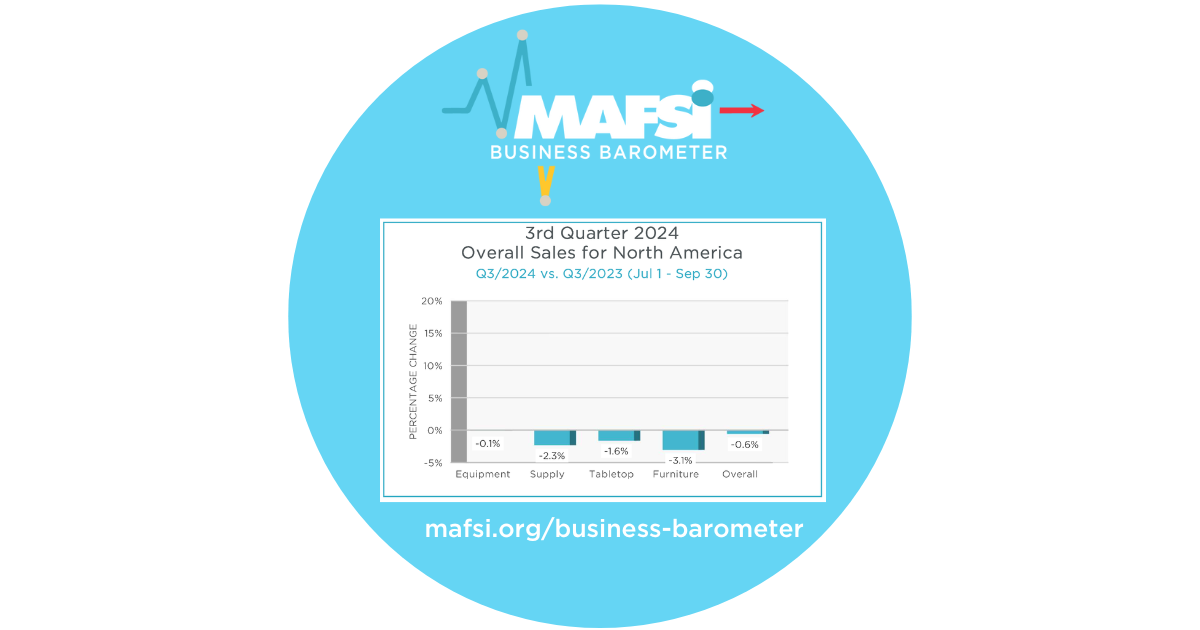

Q3/2024 MAFSI Business Barometer: Third Quarter Sales Once Again Are Negative. Fourth Quarter Forecast Is for Zero Growth.

December 5, 2024

Third Quarter Sales Once Again Are Negative.

Fourth Quarter Forecast Is for Zero Growth.

Overall sales for Q3/24 were negative at -0.6% overall.

This was the second consecutive quarter of negative growth,

but slightly better than the forecast of -1.6%.

The results varied by region ranging from

+2.2% in the West, +0.9% Midwest, -1.1% in Canada,

-2.7% in the Northeast, and -3.3% in the South.

All 4 categories of product recorded negative results.

See the Q3 2024 Commercial Foodservice Business Barometer.

This was the 13th consecutive quarter of shrinking industry sales following the “post covid” surge in demand, fueled by shortages, high inflation, and pent-up demand.

The forecast for Q4/24 is for ZERO growth. If this is in fact the result, the earlier expectation of a second half 2024 rebound will have been erroneous.

As we finish out this “no growth” year and set our sights on 2025, MAFSI reps are forecasting a modest recovery at +2.7% for this next year.

This is broken down as follows: + 3.0% Supplies, +2.8% Equipment, + 2.5% Tabletop and +1.3% in Furniture.

Slight improvements are forecast for both Quoting and Consultant activity.

Likely the industry will adapt to the “new normal” with improved results in 2025. We are about to enter the fourth leg of the elongated “W” shaped curve of the Covid era: first was the shutdown plunge, second the reopening surge, third the slow decline towards normalization, and next the upward return to slow to moderate growth.

Executive Summary written by Michael R. Posternak, CEO, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com.

See the Q3 2024 Commercial Foodservice Business Barometer.

Comments