Q4/2024 MAFSI Business Barometer: Industry Sales Turn The Corner Into Small But Positive Growth, (Potential) Tariff Impacts Make It Nearly Impossible to Forecast Sales

February 24, 2025

Industry Sales Turn The Corner Into Small But Positive Growth, (Potential) Tariff Impacts Make It Nearly Impossible to Forecast Sales

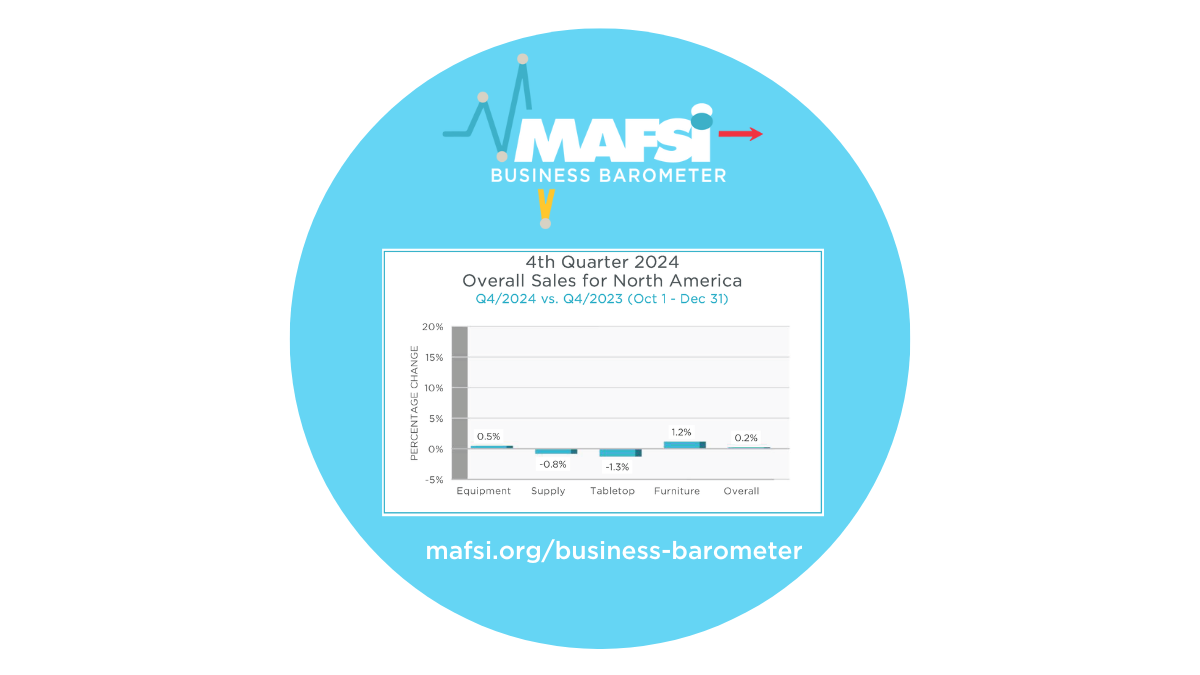

Overall sales for 4Q/24 increased by +0.2% from -0.6% the previous quarter and were slightly above the forecast of 0%.

By product category, furniture was up by +1.2%, equipment by +0.5%, while Durable Supplies decreased by -0.8% and Tabletop by -1.3%.

See the Q4 2024 Commercial Foodservice Business Barometer.

Overall sales for 4Q/24 increased by +0.2% from -0.6% the previous quarter and were slightly above the forecast of 0%. This was the first quarter of any growth whatsoever after 13 quarters of declining sales. (Actually, declining rates of sales growth for 10 consecutive quarters, a flat quarter 1Q/24 and two quarters of sales declines.) This represents the first indication that we have hit bottom and have turned the corner and are starting the fourth and upward leg of Covid disruption towards normalization.

By product category, furniture was up by +1.2%, equipment by +0.5%, while Durable Supplies decreased by -0.8% and Tabletop by -1.3%.

Regional variations were significant, led by Canada at +2.8% and the South +1.8%, while the West was at flat, the Midwest was at -0.3%, and the Northeast continued to contract at -1.9%.

The most positive indicators were that Quoting Activity was reported at (reps experiencing) 38% more vs. 13% less (a differential of +25, up from +14 3Q/24 and the third consecutive quarter of positive differentials), and Consultant Activity was at 31% more vs. 12% less (a +19 differential, up from +5 3Q/24 and -6 2Q/24). Clearly, the pipeline is strengthening.

Reps are forecasting growth of +1.2% for Q1/25 and +2.7% for the full year of 2025 (the latter annual forecast the same as 3Q/24).

Obviously, the major caveat is the impact of tariffs both on stainless steel and aluminum, and products from Canada, Mexico, China, Europe and elsewhere. Likely this will lead to higher prices and shrinking demand as end users are already impacted by higher labor (costs) and food prices. The tariff issue makes it nearly impossible to forecast. Manufacturers are leaving all options open so as not to get caught in a price squeeze.

Executive Summary written by Michael R. Posternak, CEO, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com.

See the Q4 2024 Commercial Foodservice Business Barometer.

Comments