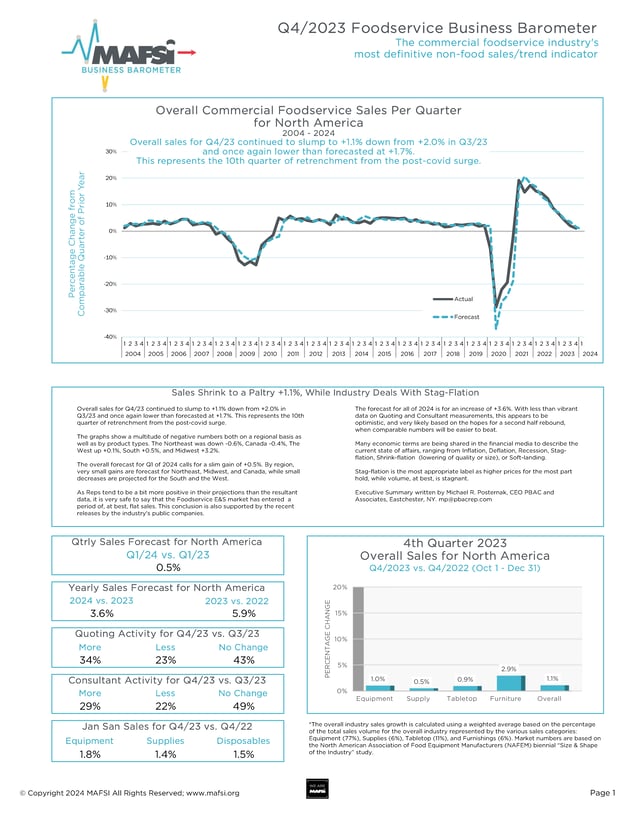

Q4/2023 MAFSI Business Barometer: Sales Shrink to a Paltry +1.1%, While Industry Deals With Stag-Flation

March 28, 2024

Sales Shrink to a Paltry +1.1%, While Industry Deals With Stag-Flation

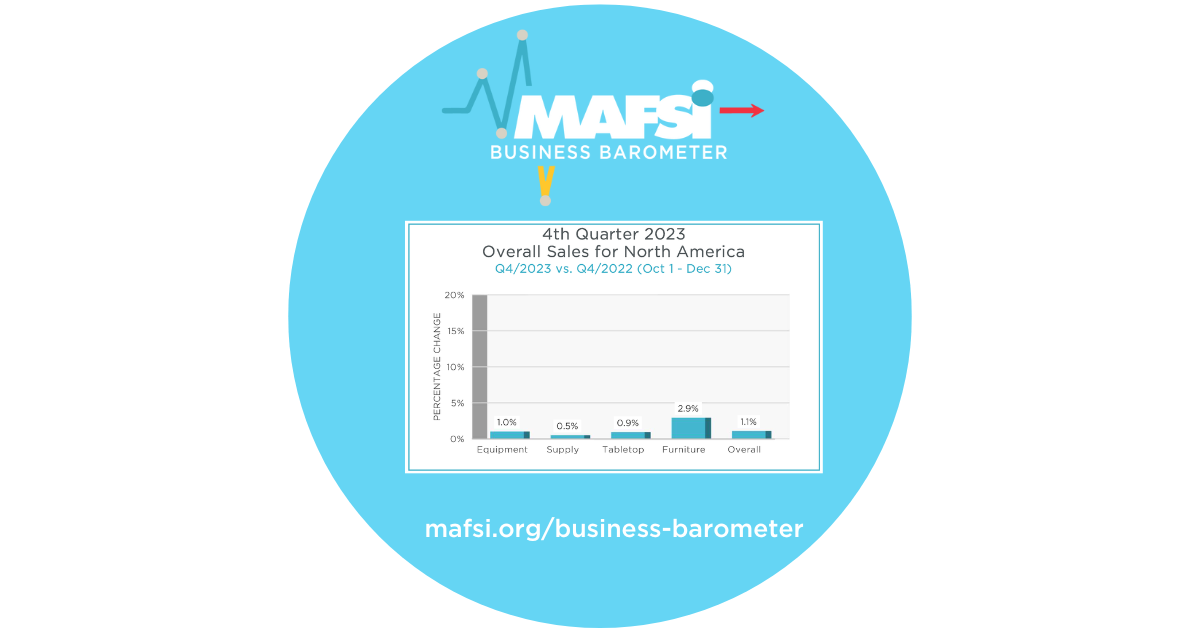

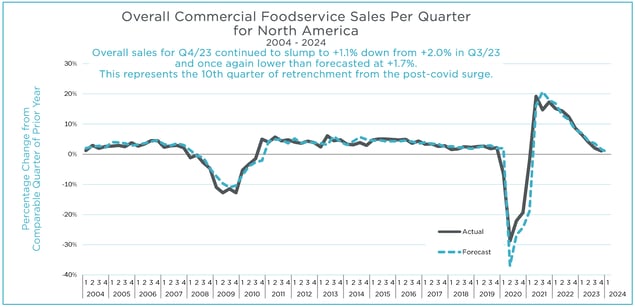

Overall sales for Q4/23 continued to slump to +1.1% down from +2.0% in Q3/23 and once again lower than forecasted at +1.7%. This represents the 10th quarter of retrenchment from the post-covid surge.

See the Q4 2023 Commercial Foodservice Business Barometer.

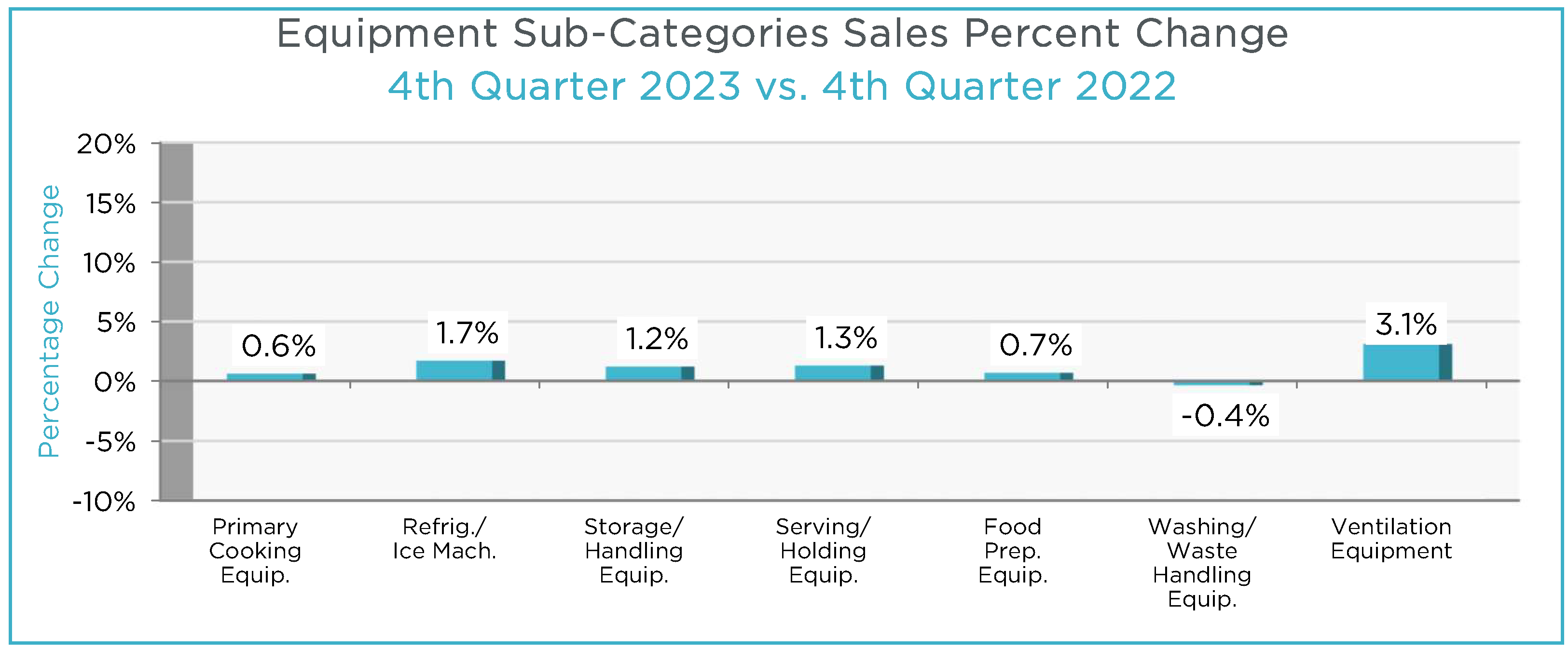

The graphs show a multitude of negative numbers both on a regional basis as well as by product types. The Northeast was down -0.6%, Canada -0.4%, The West up +0.1%, South +0.5%, and Midwest +3.2%.

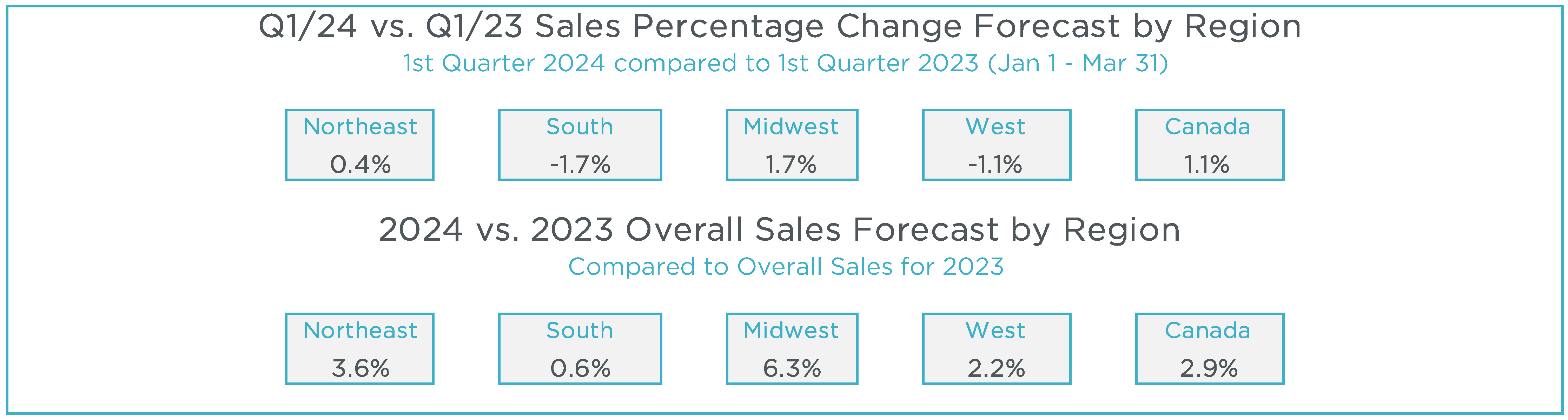

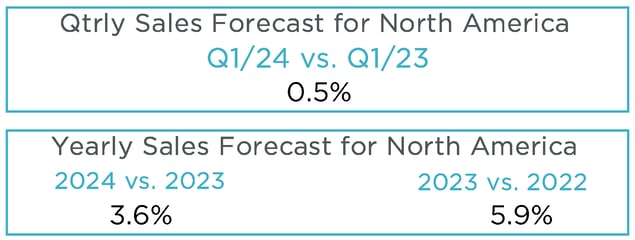

The overall forecast for Q1 of 2024 calls for a slim gain of +0.5%. By region, very small gains are forecast for Northeast, Midwest, and Canada, while small decreases are projected for the South and the West.

As Reps tend to be a bit more positive in their projections than the resultant data, it is very safe to say that the Foodservice E&S market has entered a period of, at best, flat sales. This conclusion is also supported by the recent releases by the industry's public companies.

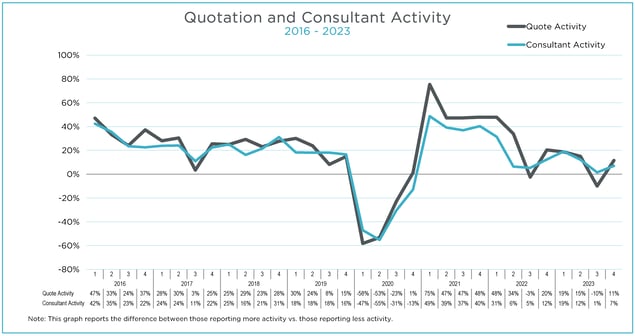

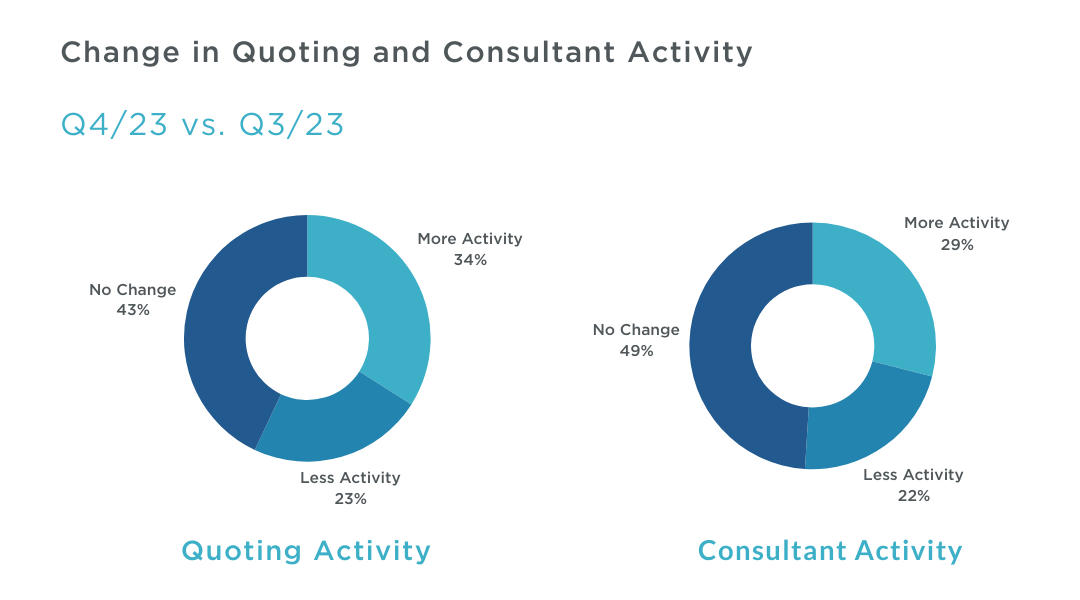

The forecast for all of 2024 is for an increase of +3.6%. With less than vibrant data on Quoting and Consultant measurements, this appears to be optimistic, and very likely based on the hopes for a second half rebound, when comparable numbers will be easier to beat.

Many economic terms are being shared in the financial media to describe the current state of affairs, ranging from Inflation, Deflation, Recession, Stag-flation, Shrink-flation (lowering of quality or size), or Soft-landing.

Stag-flation is the most appropriate label as higher prices for the most part hold, while volume, at best, is stagnant.

Executive Summary written by Michael R. Posternak, CEO, PBAC & Associates LTD. Eastchester, NY mp@pbacrep.com.

See the Q4 2023 Commercial Foodservice Business Barometer.

Comments